Convert QIF to OFX and import into Xero, QB Online, Sage One, YNAB, AccountEdge

Need to import bank or credit card transactions in a QIF file into Xero, Sage One or other OFX importing software or online service, but cannot seem to make it work? The problem is that your bank only provides transactions in a format that Xero, Sage One or other OFX importing software or online service cannot read.

The Solution: try ProperConvert (QIF2OFX) app. It can convert your transactions from QIF to OFX format.

Convert transaction files to the OFX format

- ProperConvert (QIF2OFX) extracts transactions from QIF files. It creates OFX files ready to import into Xero, Sage One or other OFX importing software or online service.

- No data entry: convert data you already have in bank or credit card transactions file format to the OFX format

- Smart: ProperConvert (QIF2OFX) understands many layouts. It finds columns like date, amount, description, etc. of your transactions.

- Easy to use: Converting your banking transactions into OFX files could not be any easier. In a few clicks, you will have all your transactions converted to importable by Xero, Sage One or other OFX importing software or online service format in no time at all.

- Free trial and support: try it for Free before you buy and receive full support before and after you order.

- Safe to use: ProperConvert (QIF2OFX) converts all your banking transactions on your computer.

How can I use ProperConvert (QIF2OFX) to convert transactions from QIF format?

- Download, install and run the software

- Select a QIF file with transactions and review transactions

- Backup your accounting software file before importing any file

- Click Convert to convert QIF to a OFX file

- Import created file to Xero, Sage One or other OFX importing software or online service

Convert QIF to OFX (how to use QIF2OFX)

This tutorial shows how to convert a QIF file from your bank or credit card statement to the OFX format and import into Quickbooks Online or another accounting software supporting OFX import.

Use the ProperConvert app to convert QIF to OFX. Other formats are supported as well.

Step by step instructions for Windows

Follow the steps below for the Windows version, followed by the Mac version.

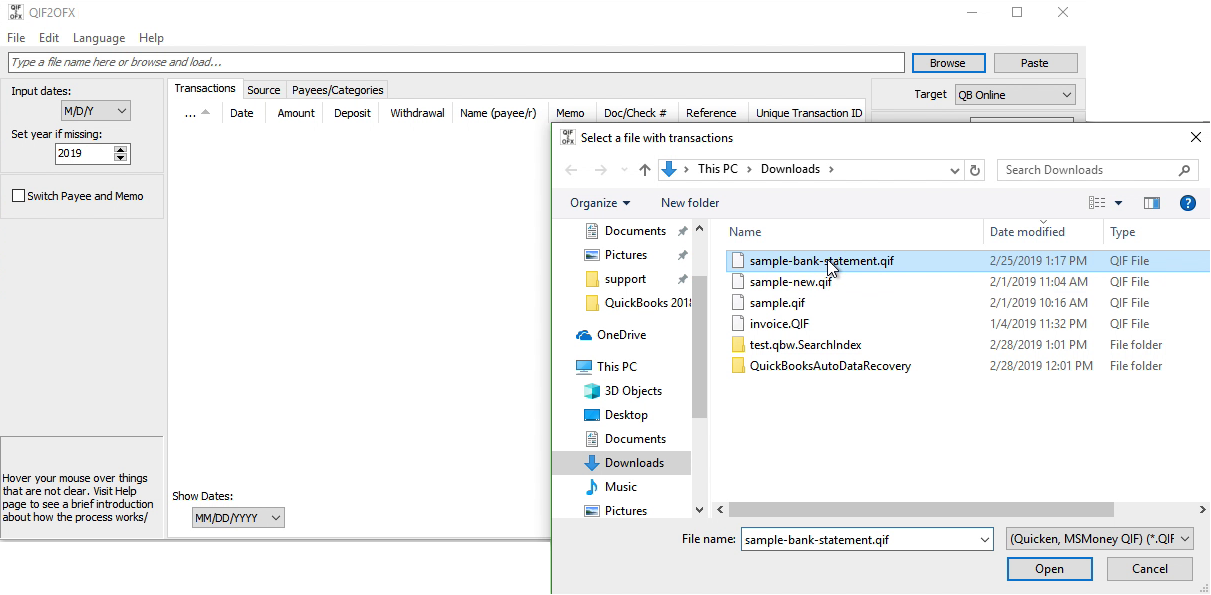

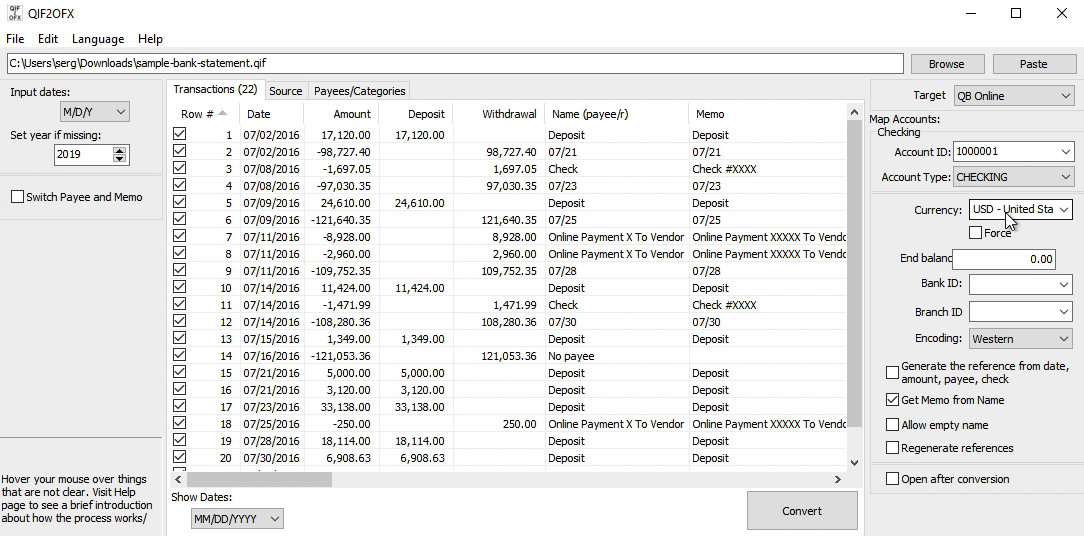

Make sure you are using the latest version of QIF2OFX. Download it from the QIF2OFX download page. Start QIF2OFX and select a QIF file.

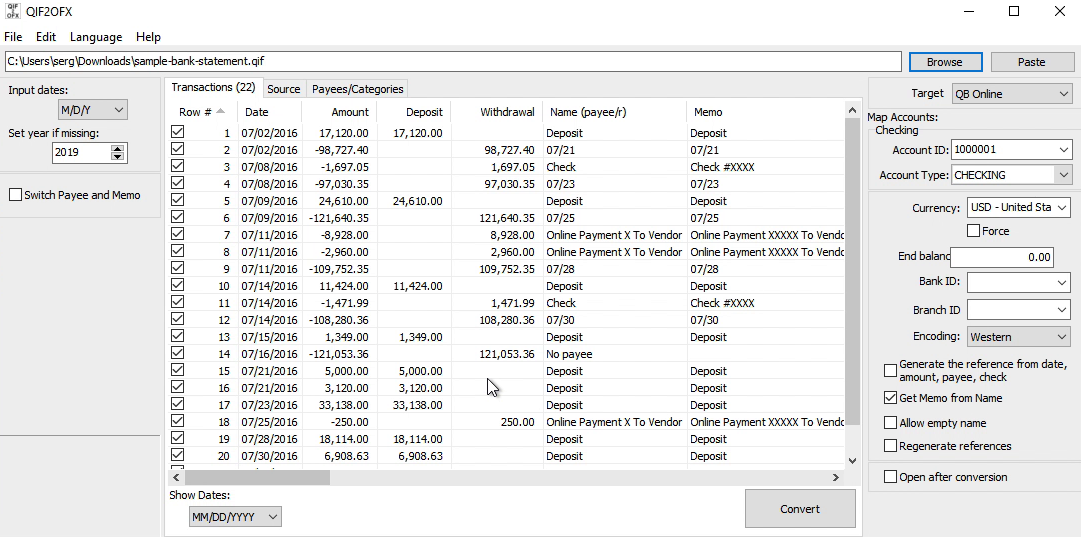

Review transactions before converting, check that dates are correct, have the correct year, deposits, and withdrawals are assigned correctly.

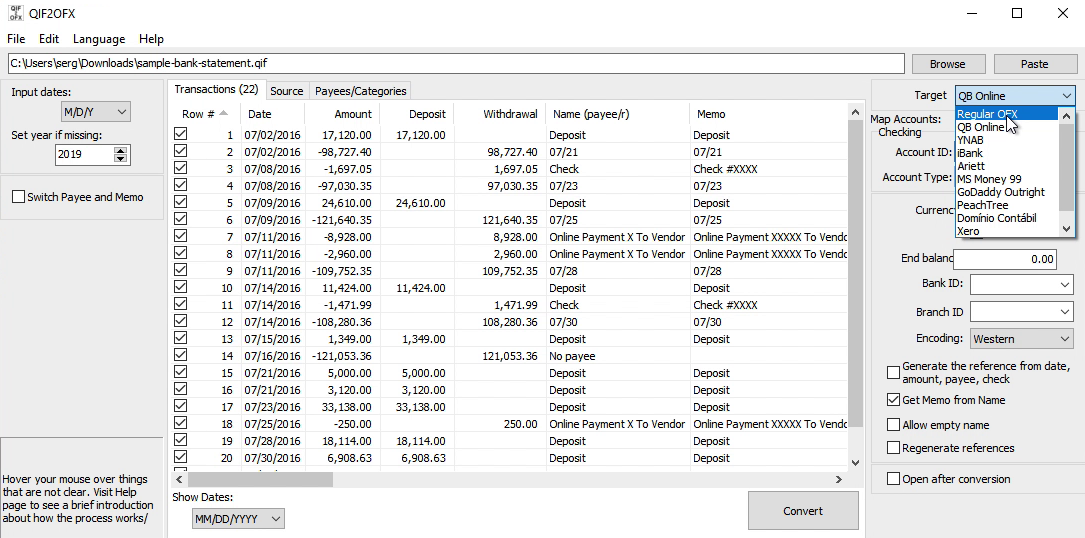

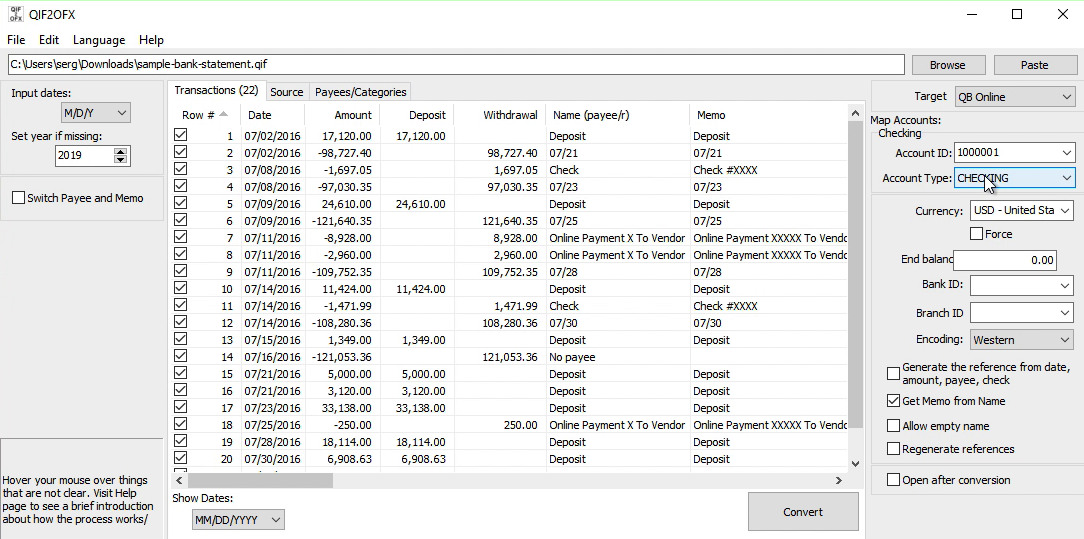

Set the OFX Target to match your accounting software or use 'Regular OFX' as the default setting.

Set the Account ID (number) and the Account Type. For multiple accounts, use a different Account ID for each account.

Currency should be USD even for non-USD accounts for Quickbooks US edition. For the Canadian edition, you can use USD and CAD. And for the UK edition, GBP currency must be set. Also check End balance, Bank ID, and Branch ID.

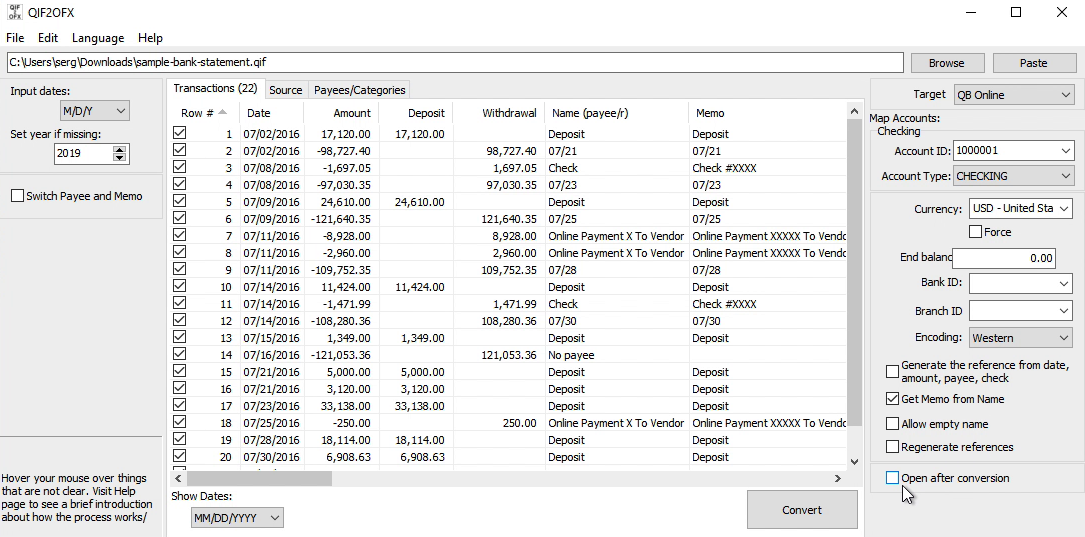

Set 'Open after conversion' to open application handling converted files to start import right after the conversion.

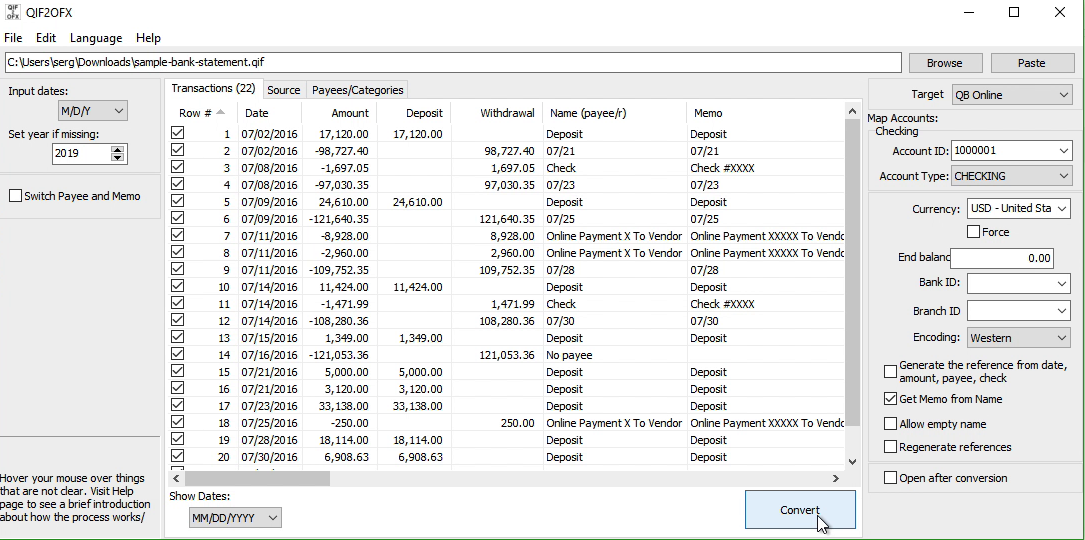

Click the 'Convert' button to create an OFX file.

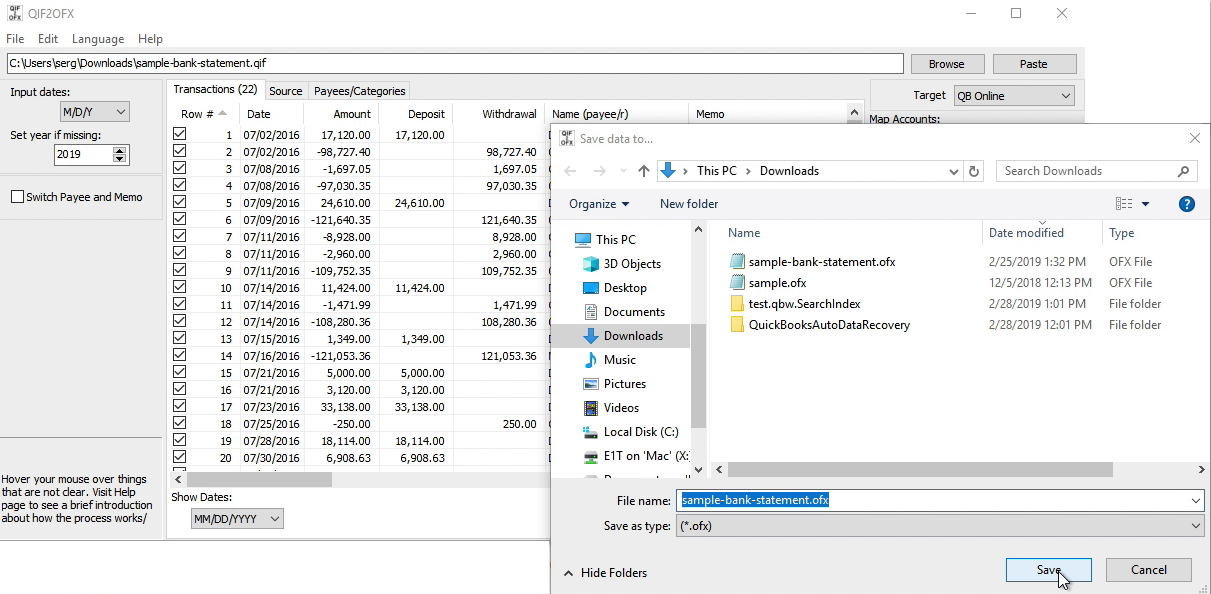

Confirm the file name and location.

Import created OFX file into Quickbooks Online

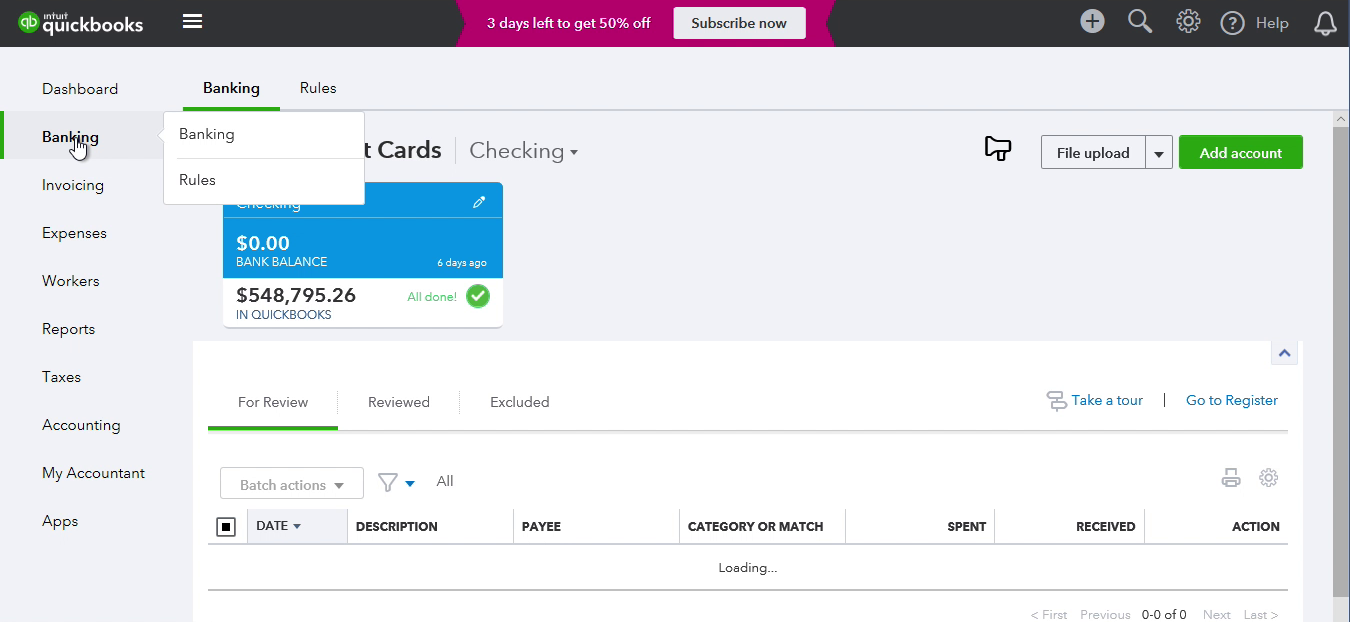

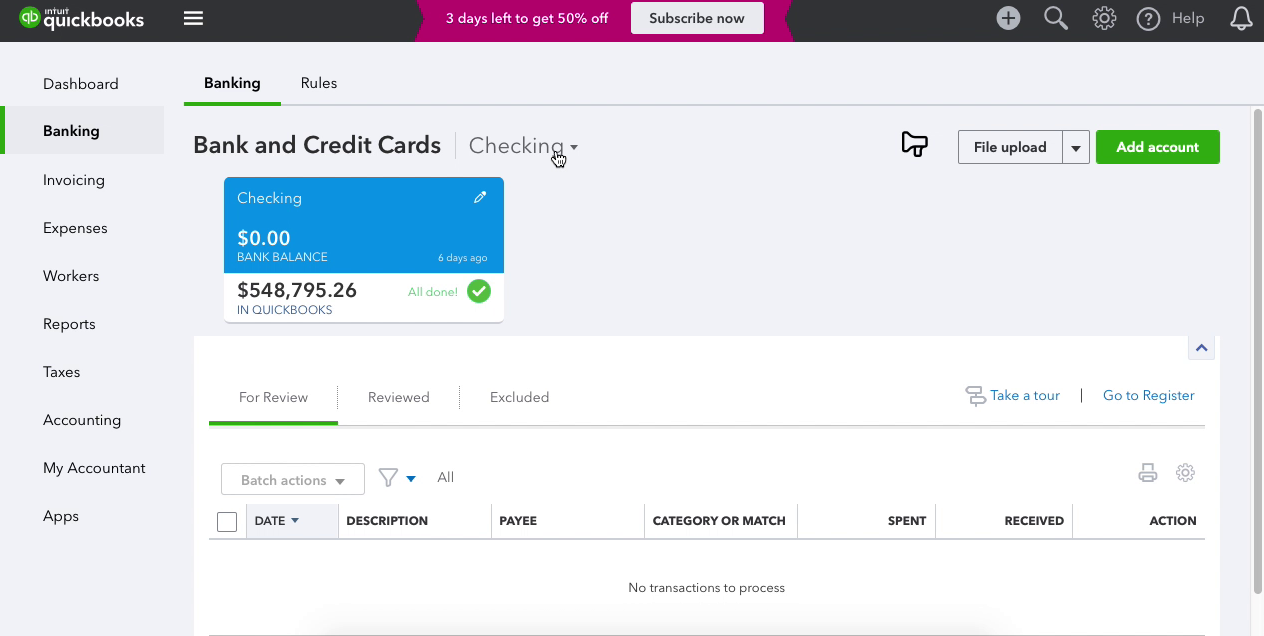

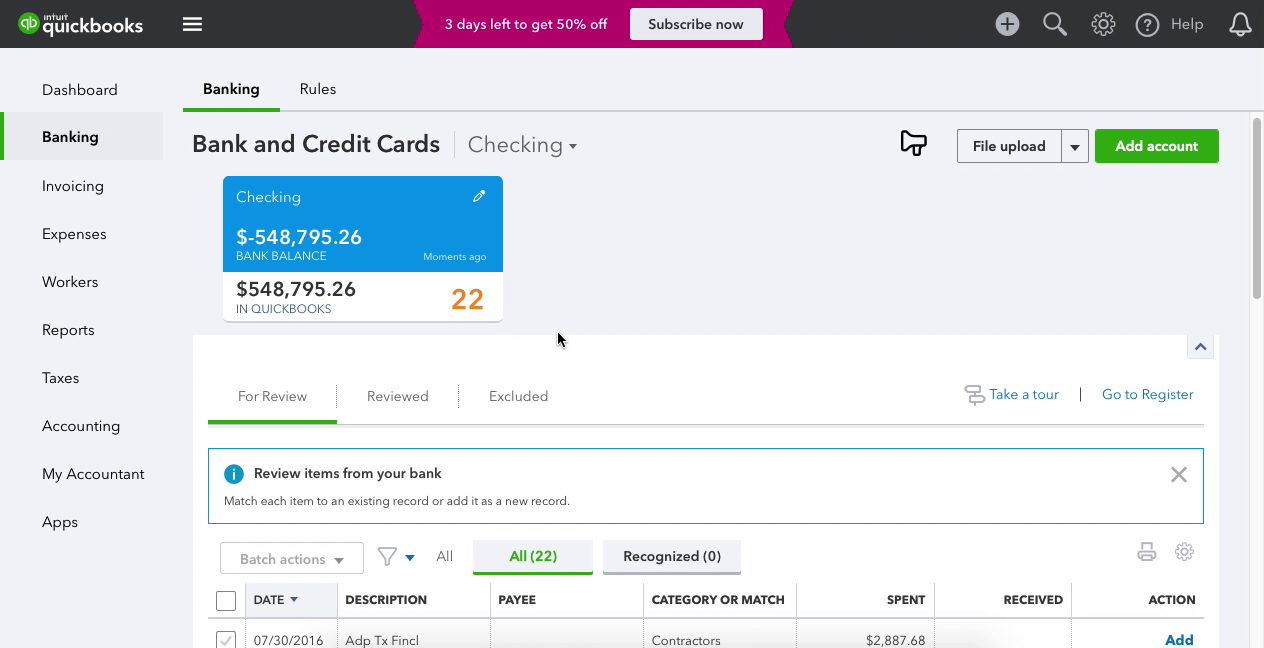

Now the OFX file is created, let's switch to Quickbooks Online and import created OFX file. Look for 'Banking' and click on it.

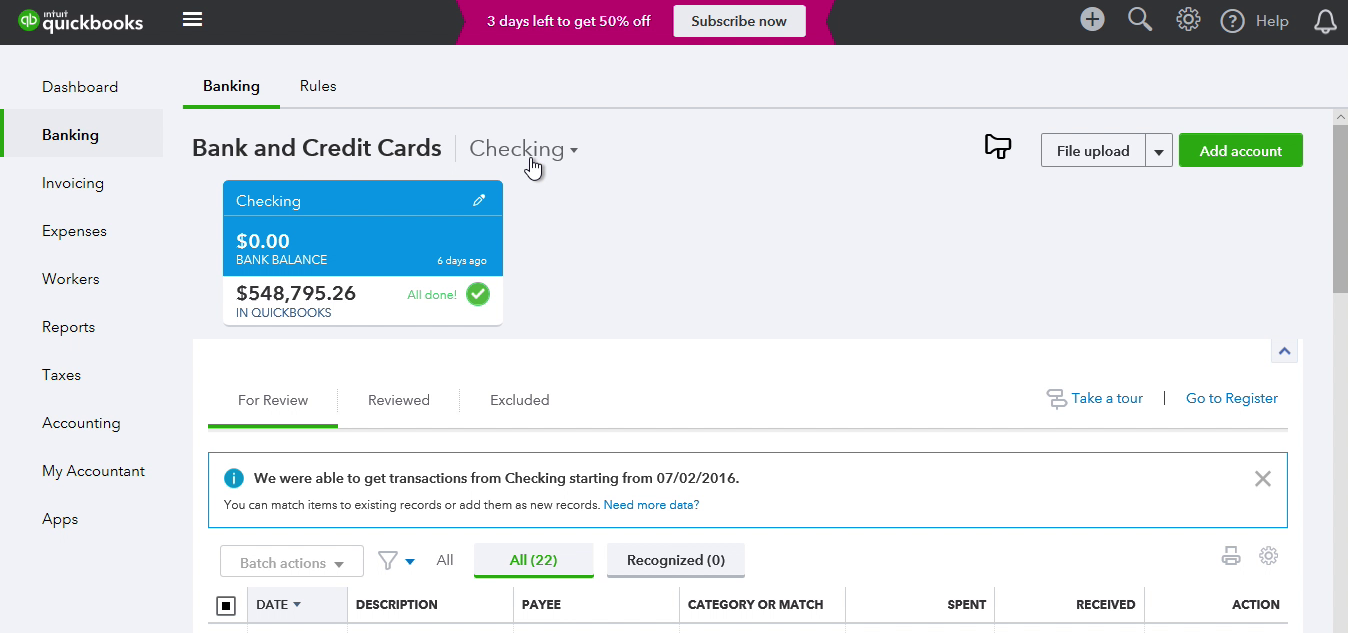

And then select the account you want to import your data into.

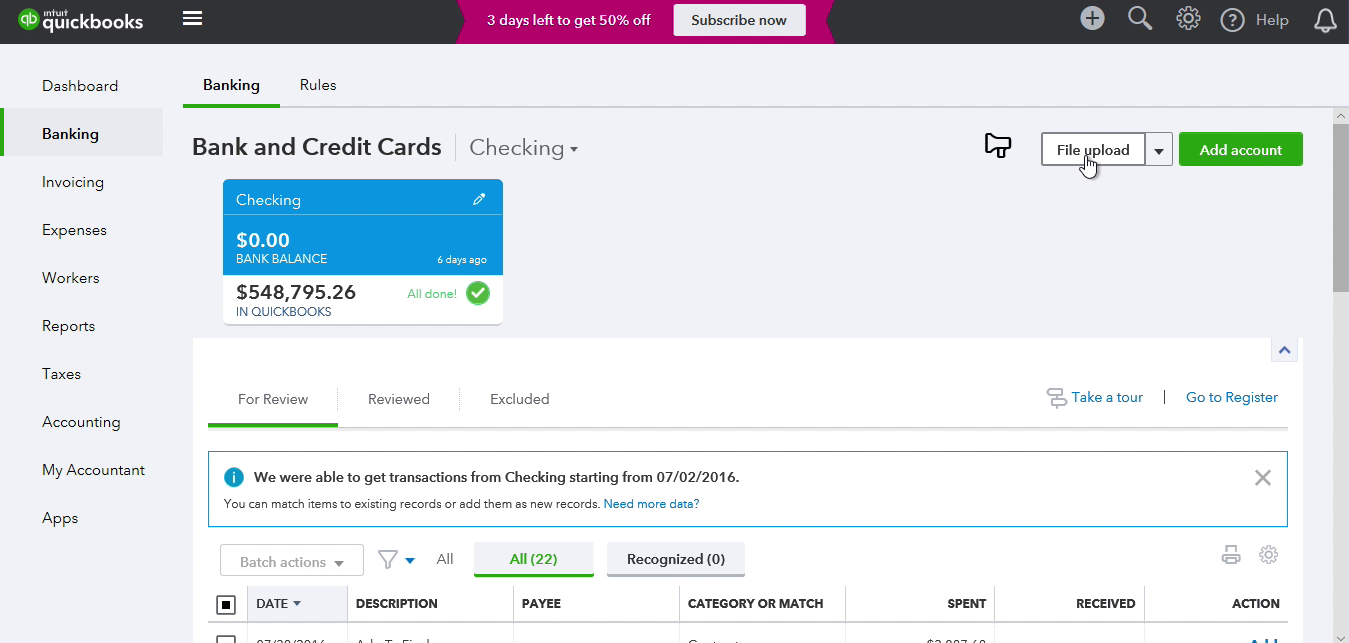

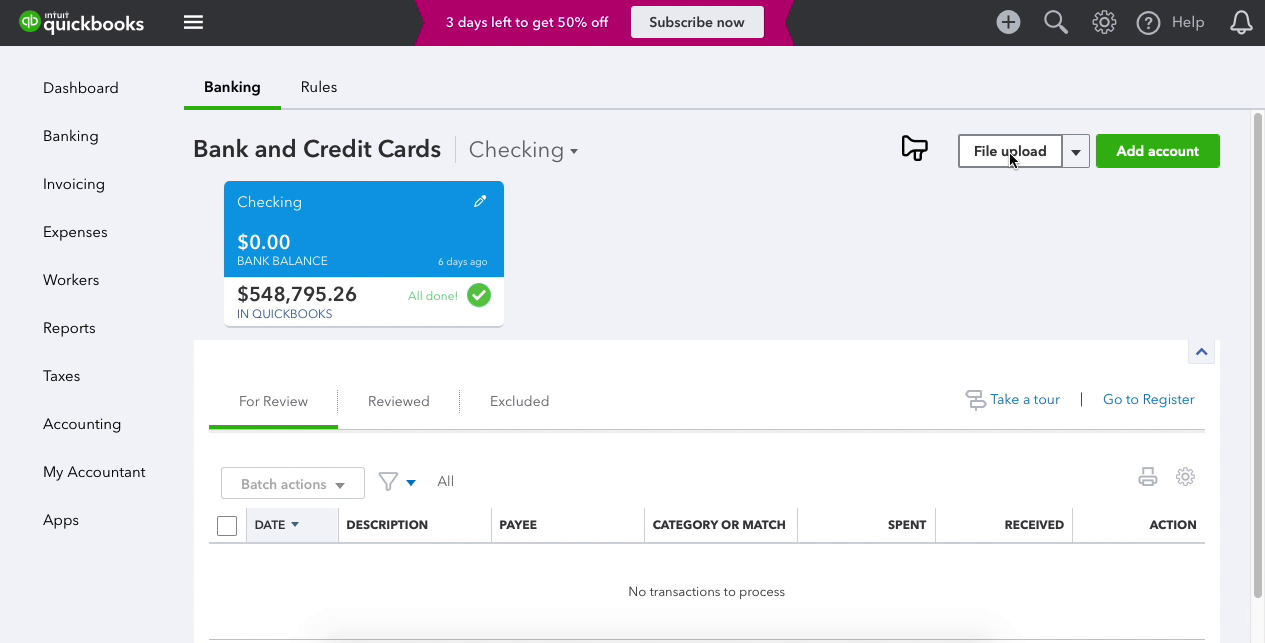

Click the 'File Upload' button. In your accounting software, look for 'Import a statement', 'Upload a bank file', or similar links to upload created OFX file.

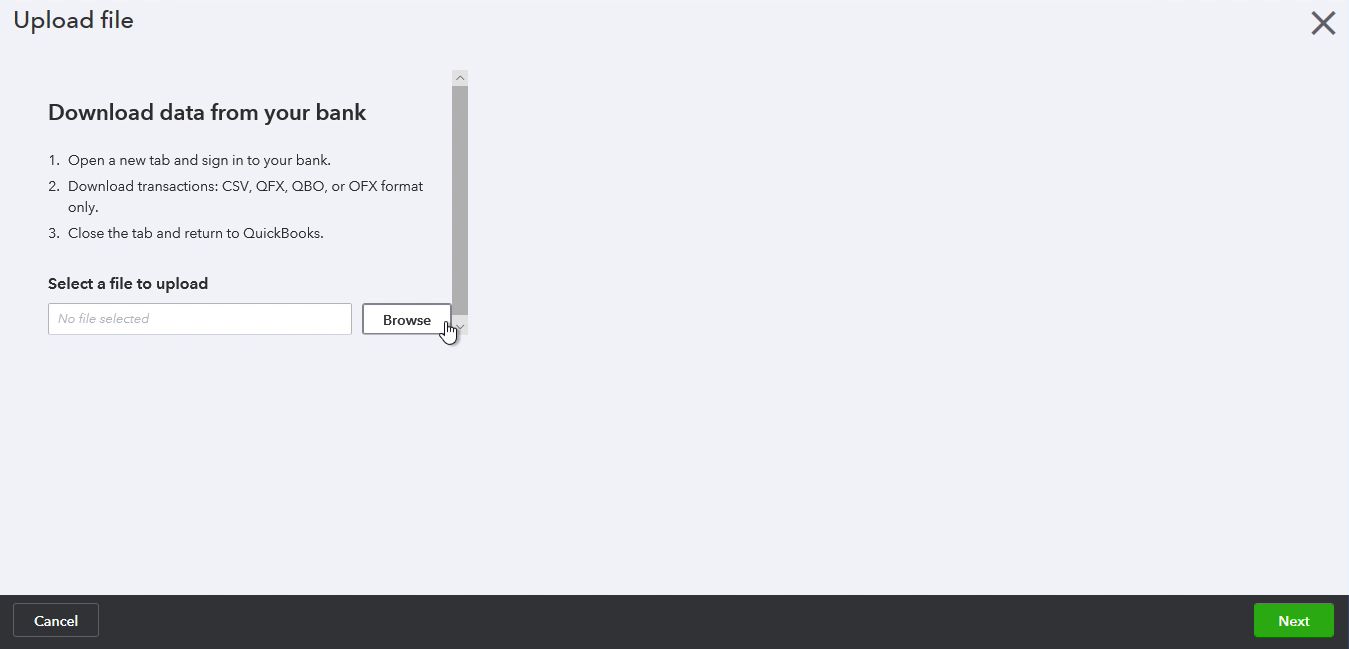

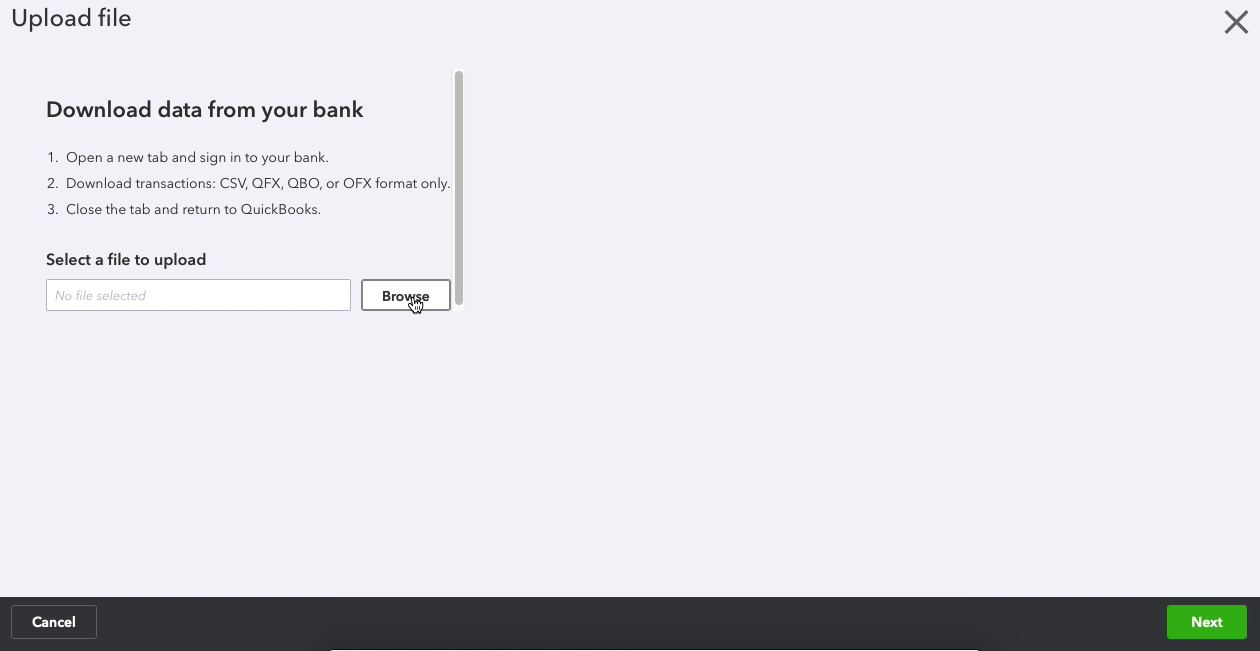

Then click 'Browse' to locate your OFX file. And click 'Next'.

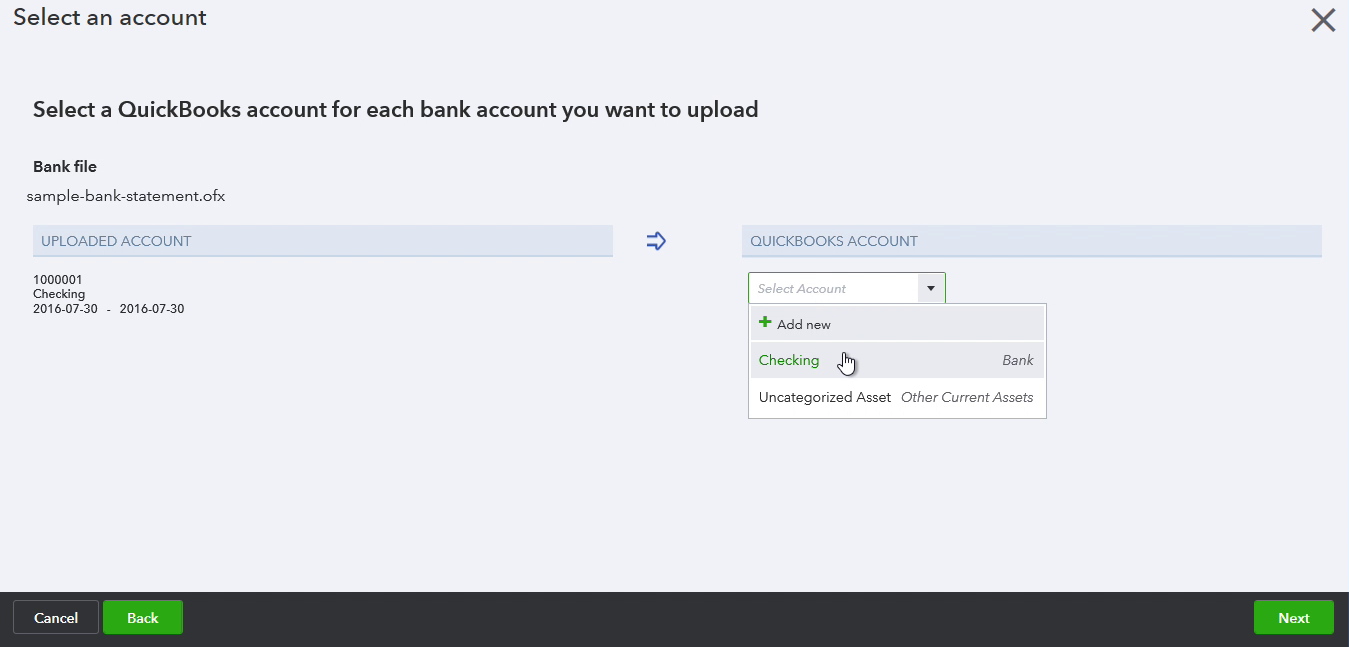

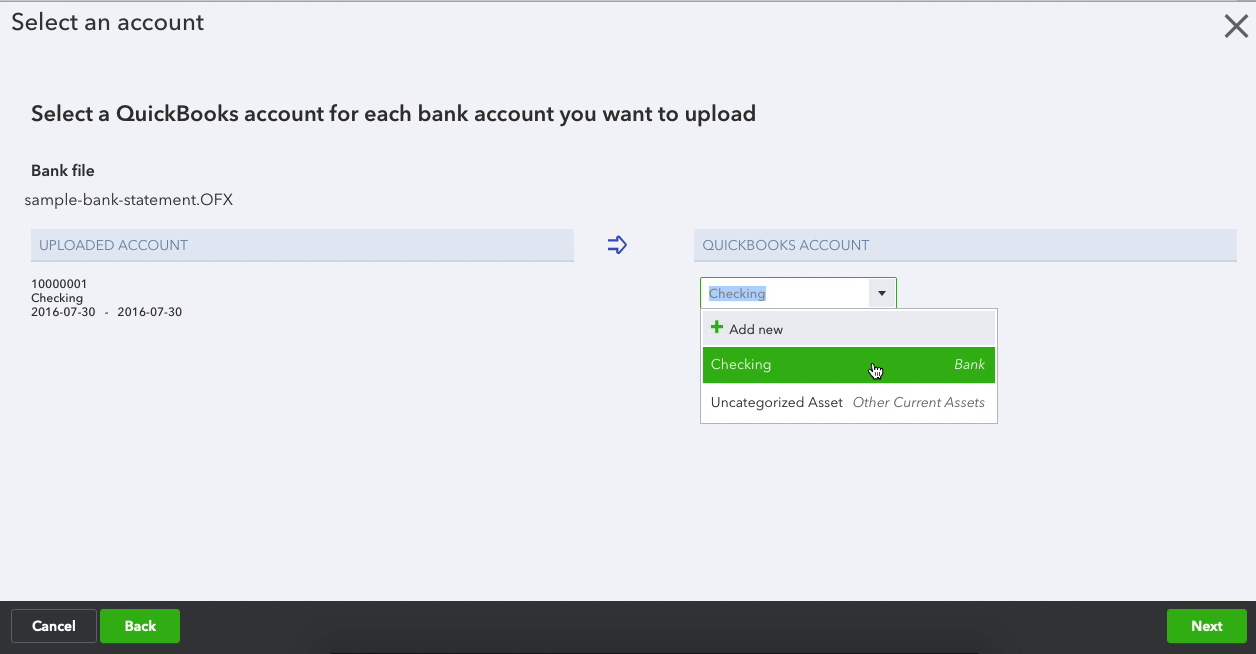

Then select an account in Quickbooks to import and click 'Next'.

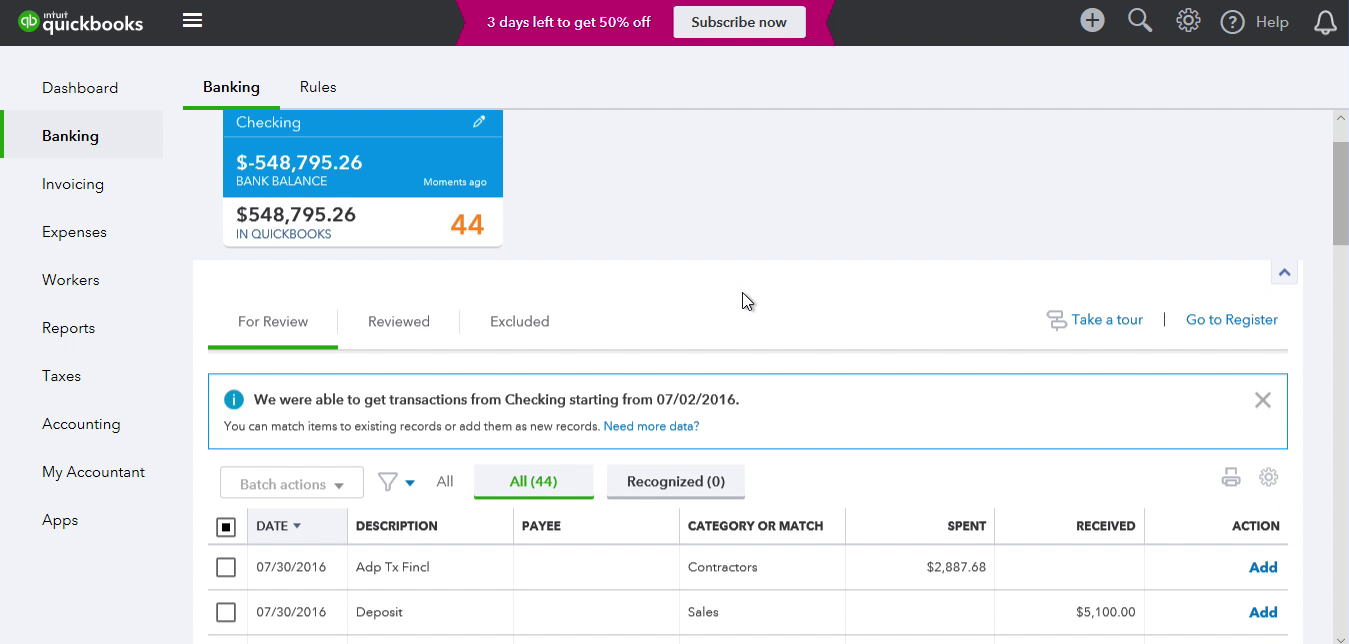

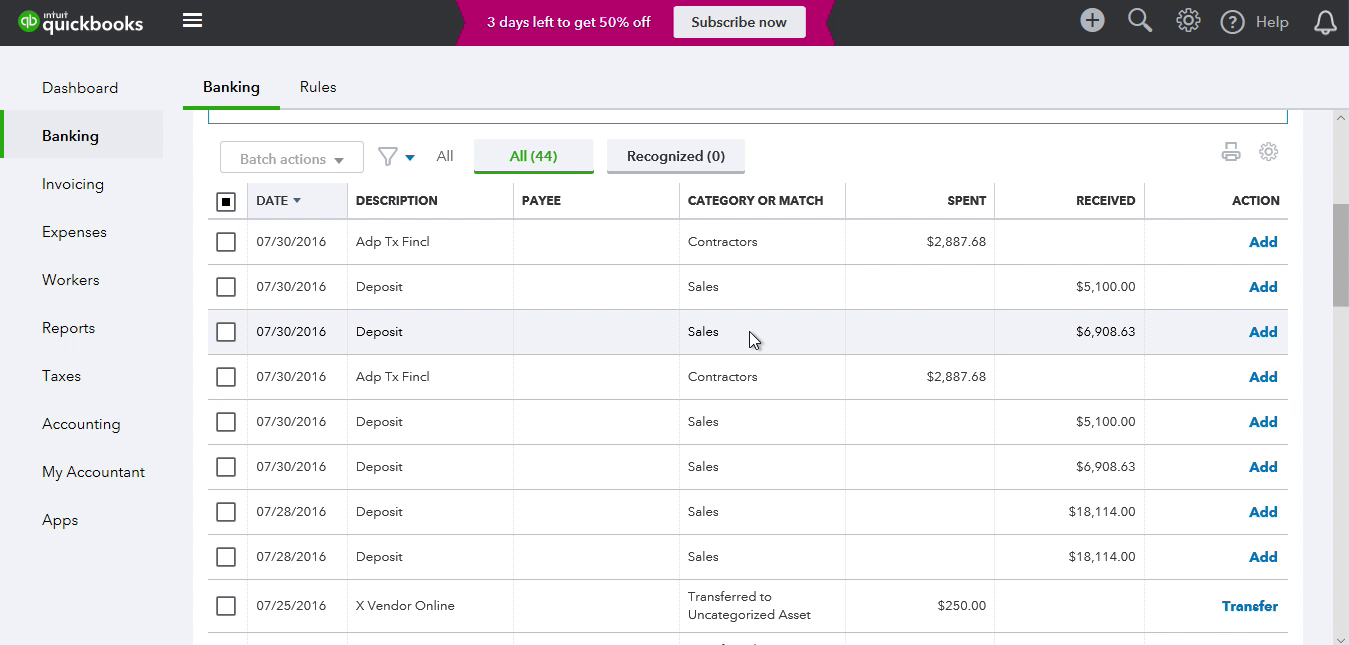

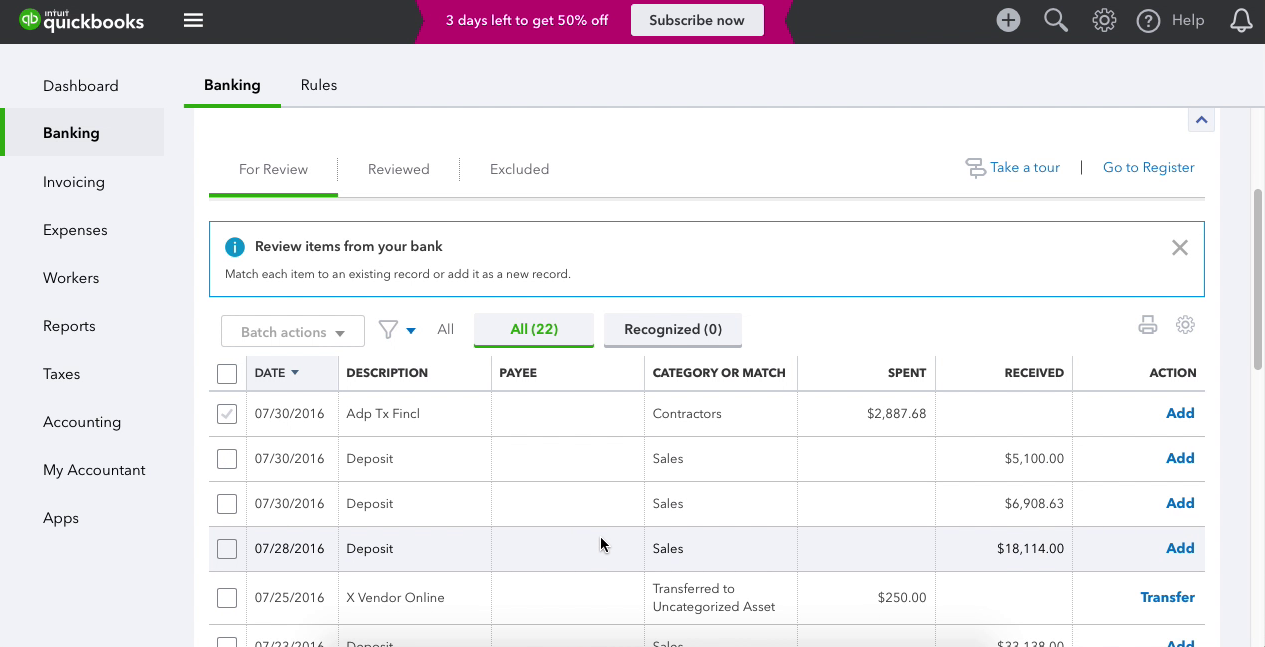

Once the transactions are imported, you can review, categorize them under the account and add them to the register.

Select Payee (Vendor Records) and Category (expense/income accounts).

See this Windows tutorial as a video:

Step by step instructions for macOS

Make sure you are using the latest version of QIF2OFX. Download it from the QIF2OFX download page.

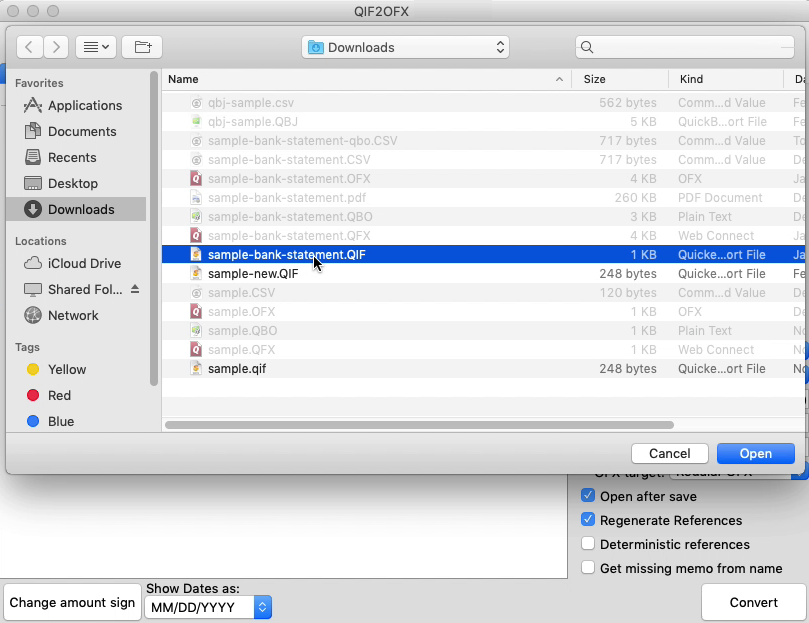

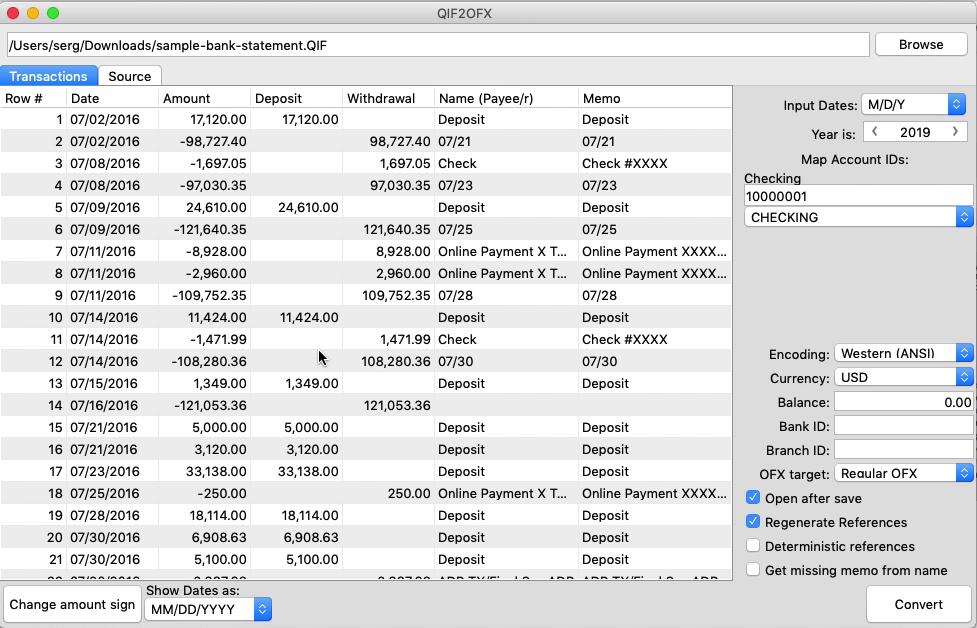

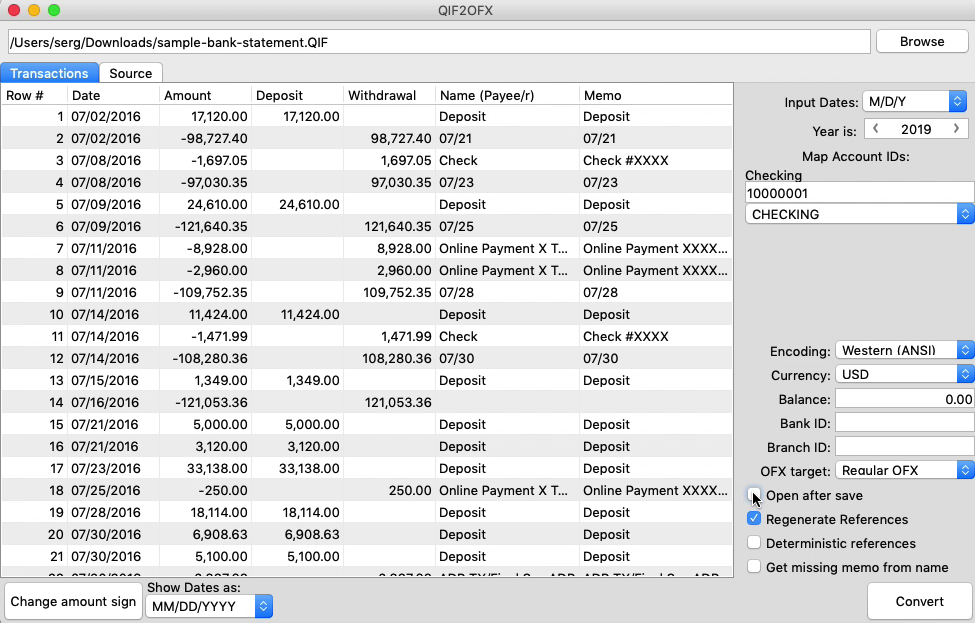

Start QIF2OFX and select a QIF file.

Review transactions before converting, check that dates are correct, have the correct year, deposits, and withdrawals are assigned correctly.

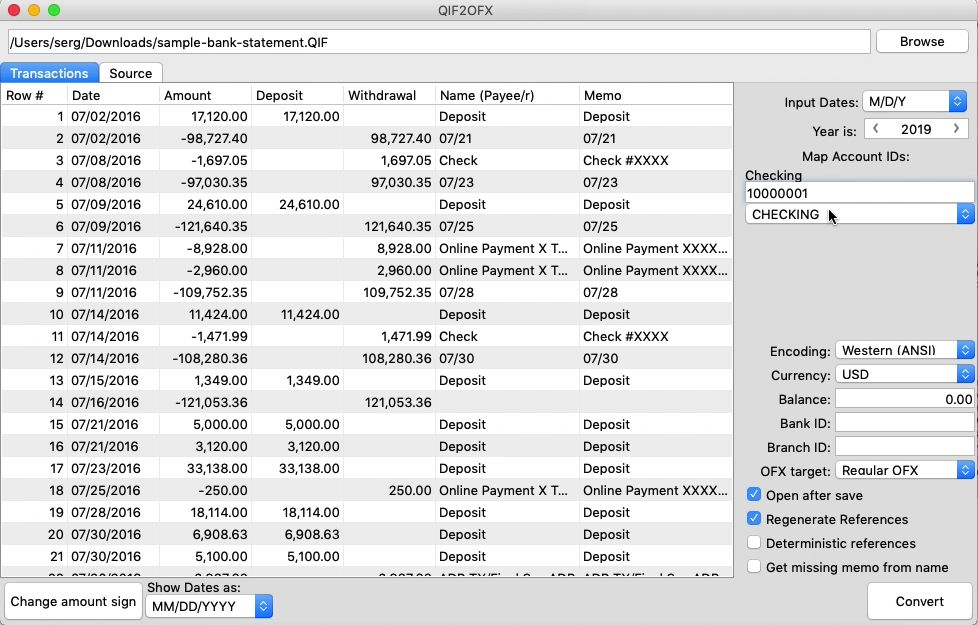

Set the Account ID (number) and the Account Type. For multiple accounts, use a different Account ID for each account.

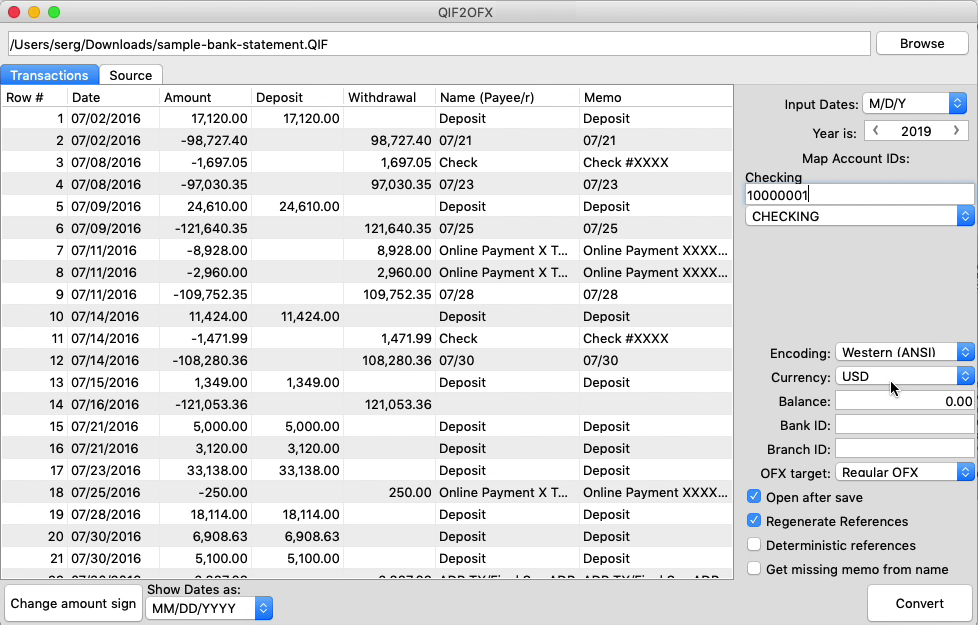

Currency should be USD even for non-USD accounts for Quickbooks US edition. For the Canadian edition, you can use USD and CAD. And for the UK edition, GBP currency must be set. Also check End balance, Bank ID, and Branch ID.

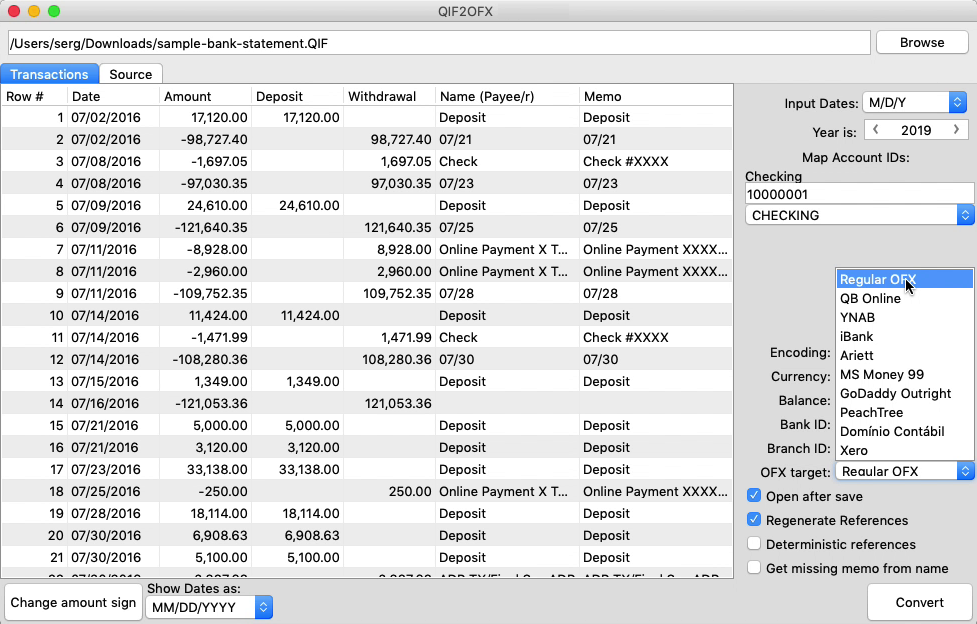

Set the OFX Target to match your accounting software or use 'Regular OFX' as the default setting.

Set 'Open after save' to open application handling converted files to start import right after the conversion.

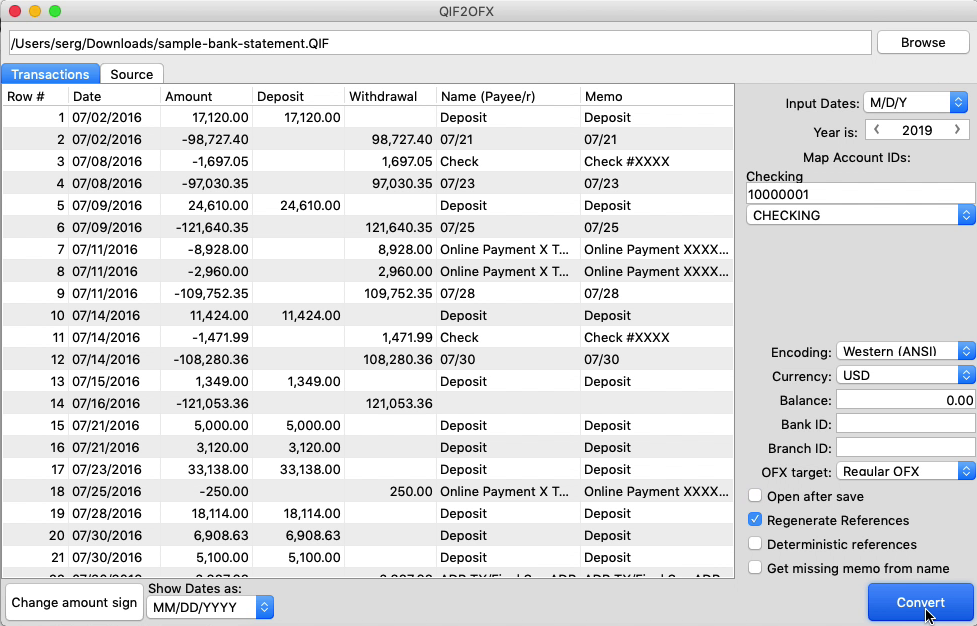

Click the 'Convert' button to create an OFX file.

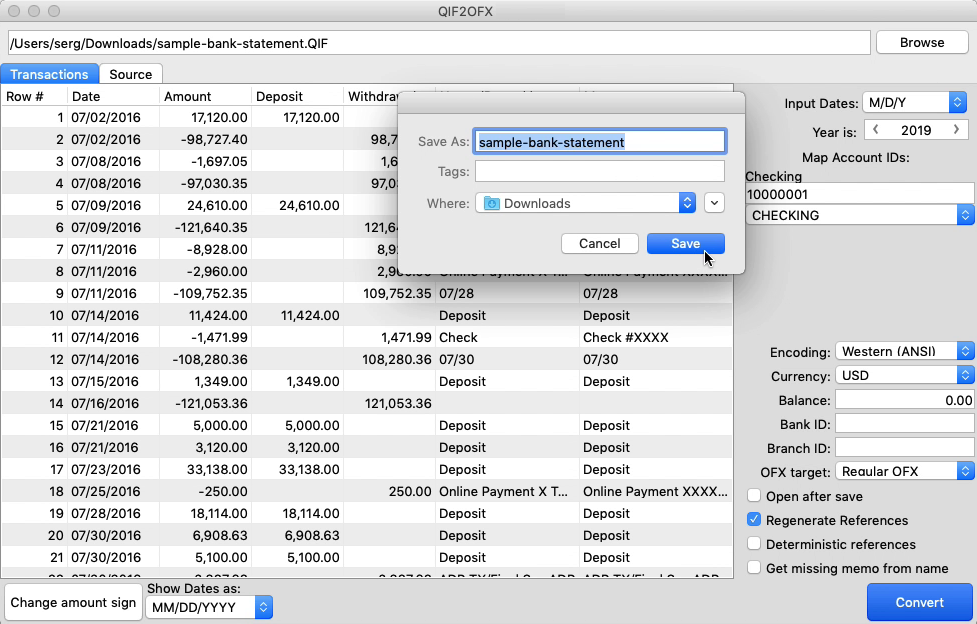

Confirm the file name and location.

Import created OFX file into Quickbooks Online

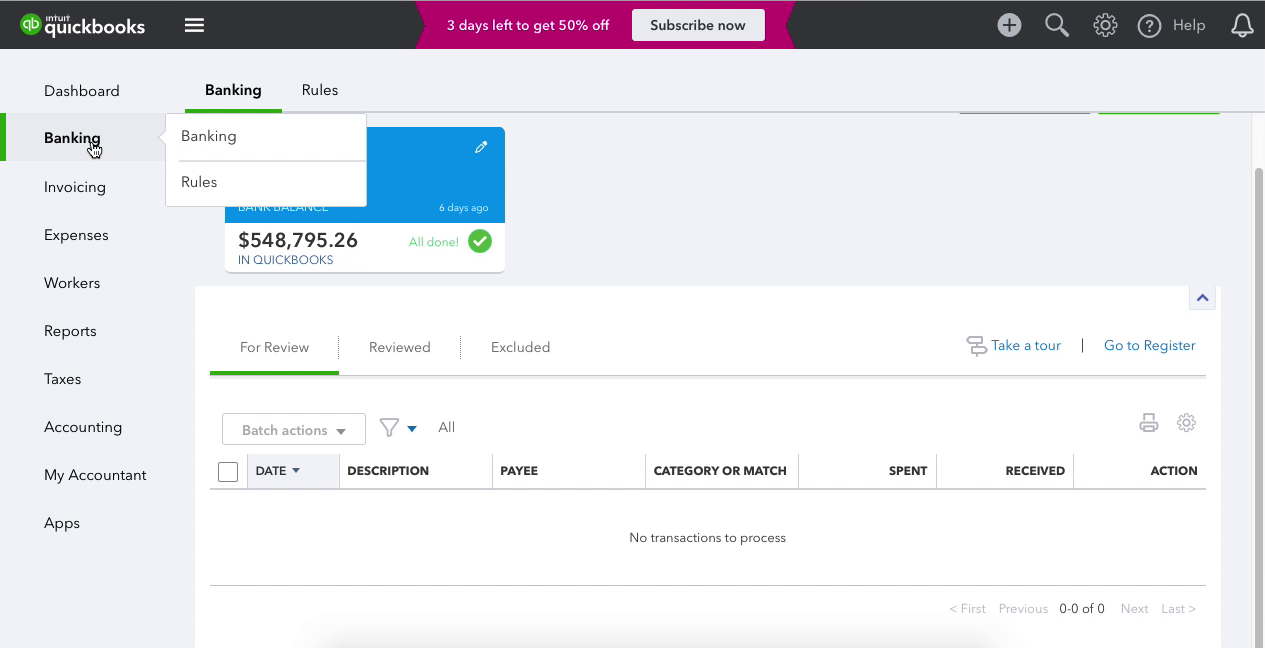

Now the OFX file is created, let's switch to Quickbooks Online and import created OFX file. Look for 'Banking' and click on it.

And then select the account you want to import your data into.

Click the 'File Upload' button. In your accounting software, look for 'Import a statement', 'Upload a bank file', or similar links to upload created OFX file.

Then click the 'Browse' button and select the created OFX file. And click 'Next'.

Then select an account in Quickbooks to import and click 'Next'.

Once the transactions are imported, you can review, categorize them under the account and add them to the register.

Select Payee (Vendor Records) and Category (expense/income accounts).

See this macOS tutorial as a video:

Related articles

- Convert QIF files to CSV/Excel (QIF2CSV)

- Convert OFX to QFX (Web Connect) and import into Quicken

- Convert OFX to QBO (Web Connect) and import into Quickbooks

- Convert QIF to QFX (QIF2QFX)

- Convert QFX files to QIF and import into Quicken (QFX2QIF)

- How to use PDF2QBO converter (PDF2QBO)

- How to use the Transactions app