ProperConvert: Extract transactions and import into your accounting software

Need to import bank or credit card transactions into your accounting or personal finance software but cannot seem to make it work? Or have general journal entries exported from your production system and need to import into Quickbooks??

The Solution: try the ProperConvert app. It can convert your transactions into a format that your accounting/personal finance software can import. For general journal entries, it converts to a file ready for Quickbooks.

Convert transactions and general journal entries to the required by your accounting software format

- ProperConvert extracts transactions from many formats like CSV, PDF, QIF, and others (see below). It creates files ready to import into your accounting software like Quickbooks, Xero, Quicken, and others.

- No data entry: convert data you already have

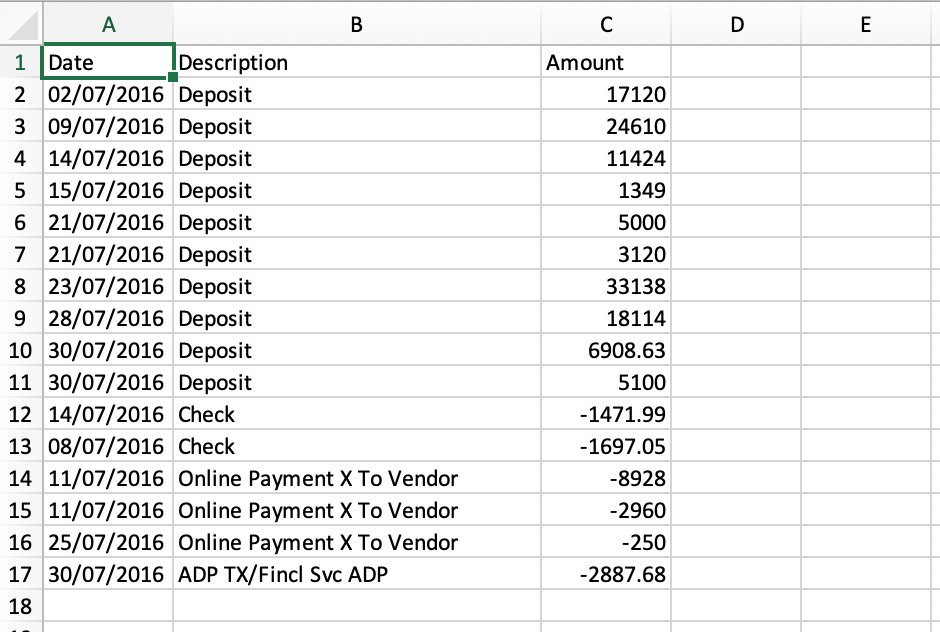

- Smart: ProperConvert understands many layouts. It finds columns like date, amount, description, etc. of your transactions.

- Easy to use: Extracting data from your files could not be any easier. In a few clicks, you will have all your data converted to a compatible format in no time at all.

- Free trial and support: try it for Free before you buy and receive full support before and after you order.

- Safe to use: the application converts your data on your computer and does not upload any of your data to the cloud.

Extract and Convert Transactions

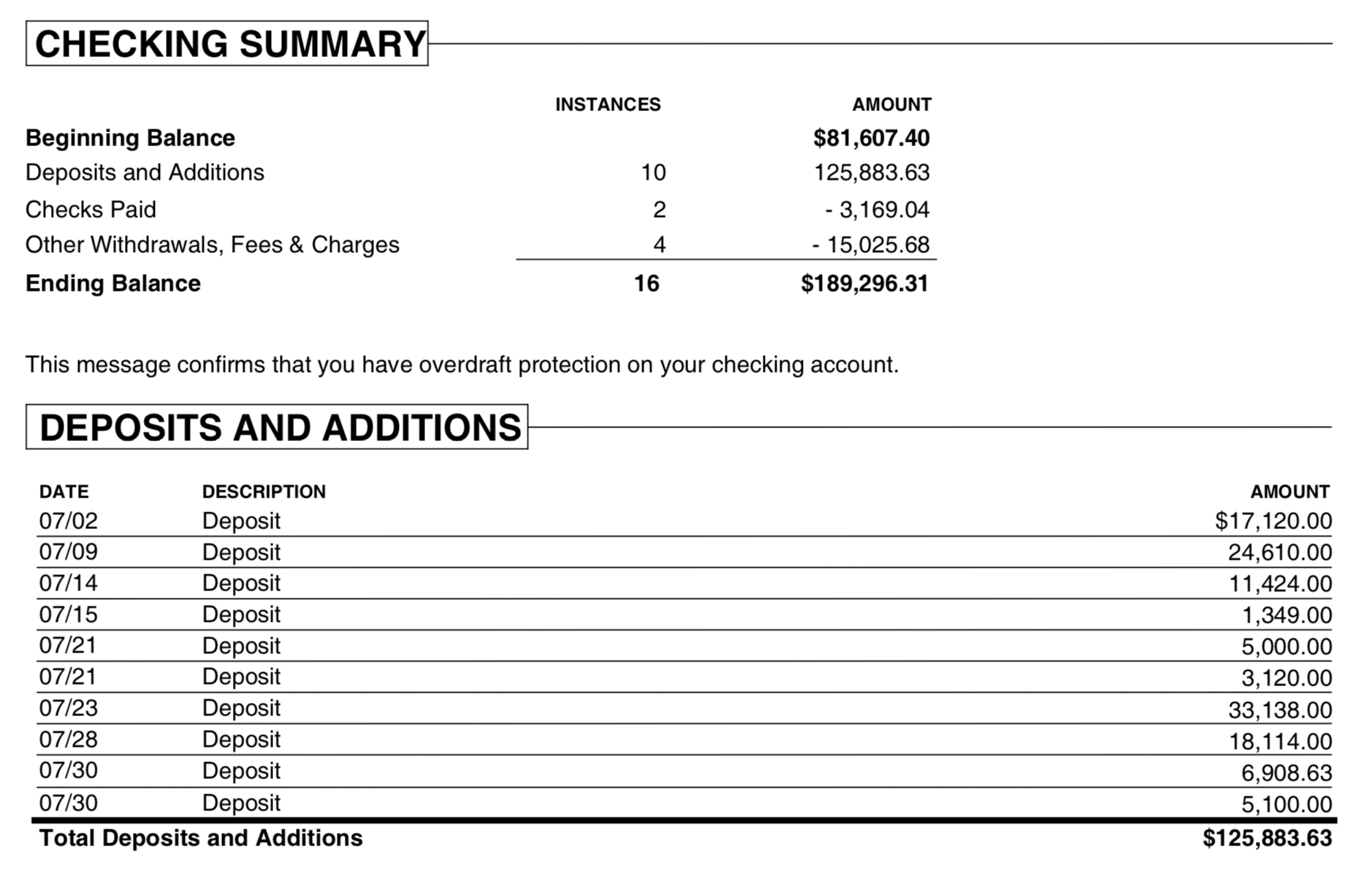

For bank and credit card transactions, the ProperConvert app converts from the following formats:

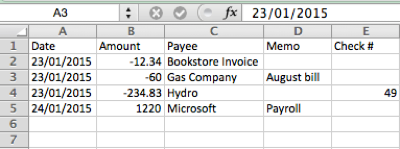

- CSV/XLS/XLSX/TXT (and copy/paste from any spreadsheet desktop or online software)

- PDF (downloaded from online banking, image based, protected, scanned)

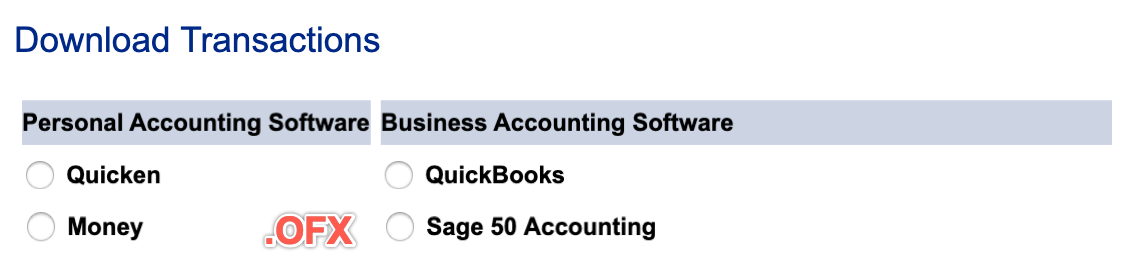

- QFX/OFX/QBO

- QIF/QMTF

- MT940/STA

The ProperConvert app converts your bank and credit card transactions files into a file format compatible with your accounting or personal finance or spreadsheet software:

- QuickBooks Desktop (all versions), convert to QBO or IIF format

- Quicken (convert to QFX, QIF, CSV Mint)

- Xero (convert to OFX, CSV)

- Sage (convert to OFX)

- Wave Accounting (convert to OFX)

- FreeAgent (convert to OFX)

- Banktivity (convert to QIF)

- Kashoo (convert to OFX)

- ZARMoney (convert to OFX)

- Excel, Numbers, Google Sheets (convert to CSV, Excel, clipboard)

- and many others importing standard financial file formats like OFX, QBO, QFX, QIF, IIF, CSV, MT940

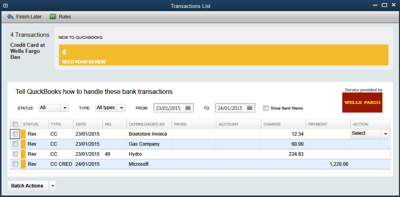

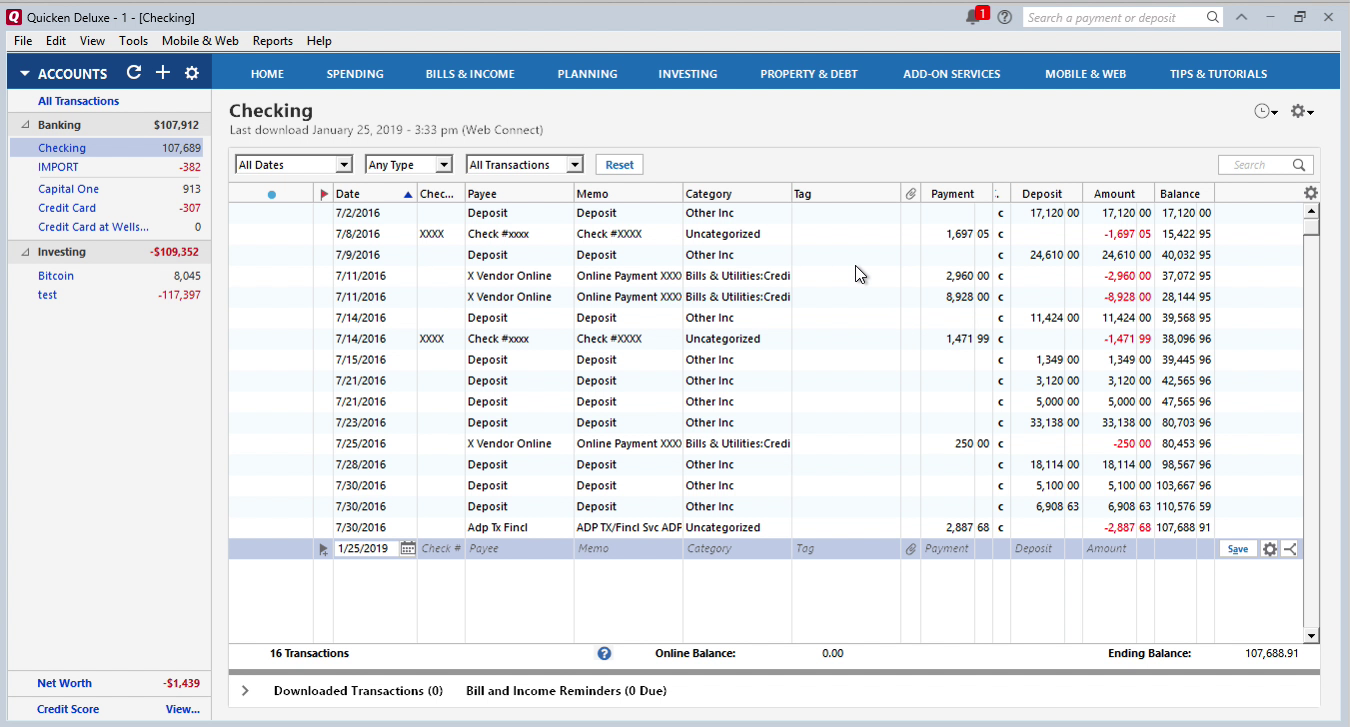

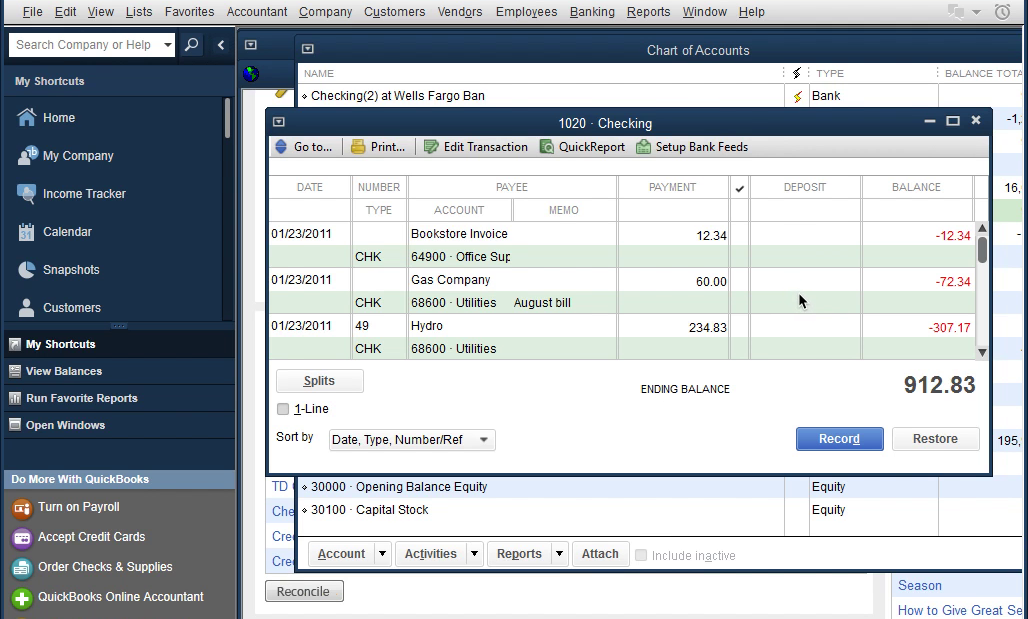

Import Into QuickBooks (Desktop and Online)

For QuickBooks desktop, convert to QBO (Bank Feeds or web connect) format or IIF format if you have QuickBooks 2021-2024. QBO and IIF files are importable by QuickBooks Enterprise as well.

For older QuickBooks Desktop versions, convert to the IIF format.

QBO (web connect) transaction files are imported the same way as transactions downloaded directly from your bank. After import, open imported statement under Bank Feeds, match vendor records and assign expense/income accounts and add transactions to the register.

IIF transaction files are imported directly into the Quickbooks Desktop register and require exact vendor names and expense/income accounts. The ProperConvert app provides interface to map payee names to vendor names and assign categories (expense/income accounts) based on payee names or direct edit.

Import Into QuickBooks Online

For QuickBooks Online, convert to QBO (web connect) format or QFX format or as CSV files (set target as "Quickbooks Online"). Quickbooks Online imports more transaction details through QBO and QFX files (date, amount, payee, memo, check) than CSV files (date, amount, description).

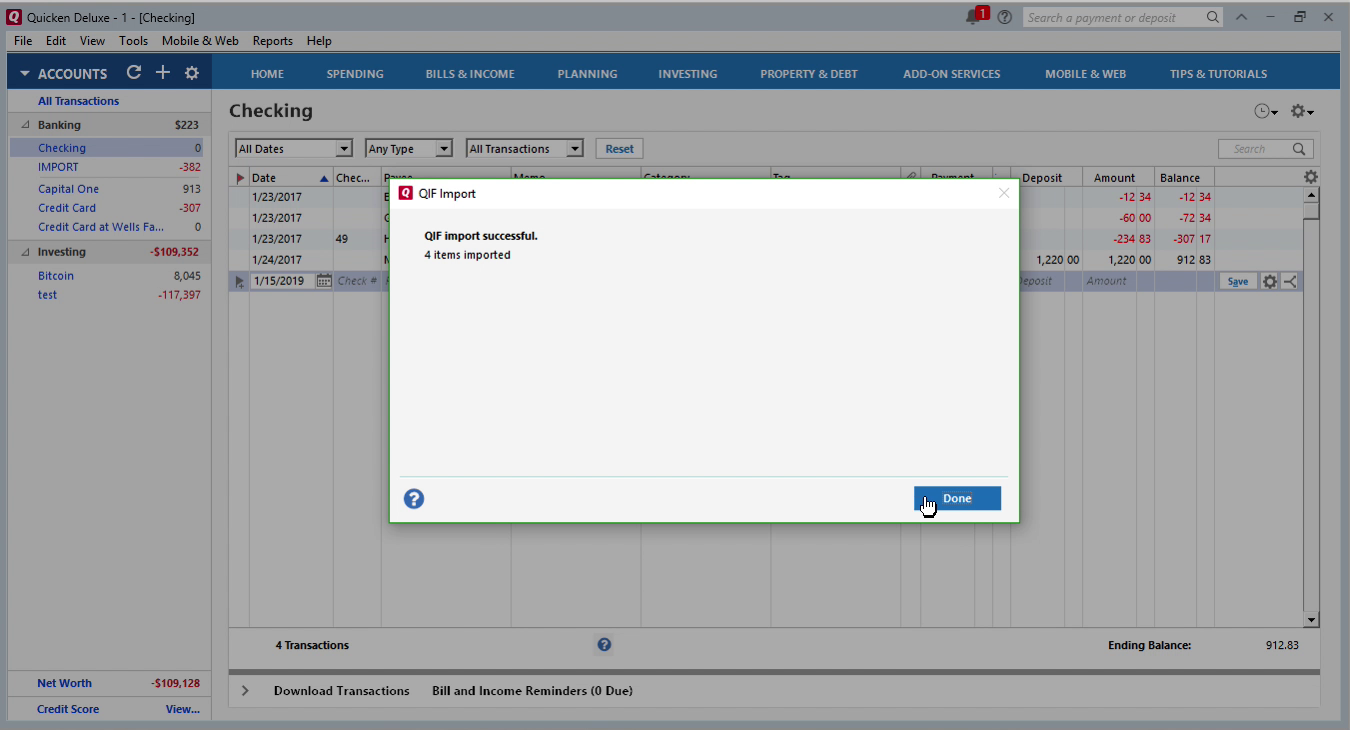

Import into Quicken

For Quicken for Windows, convert to the QIF or QFX format if you have Quicken 2021-2024.

For Quicken for Mac, convert to the QFX format is you have Quicken 2021-2024.

For older Quicken for Windows versions, convert to the QIF format.

For older Quicken for mac versions, convert to the CSV Mint format.

QIF transaction files are easily imported by Quicken (please make sure to your QIF target accordingly) and allow to supply categories and tags for each transaction. The ProperConvert app provide easy to use mapping interface to assign categories based on payee names or manually during the conversion. QIF files have less restrictions compared to QFX file as they do not identify financial institutions like QFX files.

For QFX transactions, Quicken uses the renaming rules to assign categories during import.

Import into Other Desktop Accounting or Personal Finance software (Microsoft Money and others)

Your accounting or personal finance software (like Banktivity, MYOB, Sage 50, Sage 300, NetSuite) should import transactions using one of the following files formats: CSV, OFX/QFX/QBOO, QIF. The ProperConvert app converts to all these listed formats.

For example, MS Money imports QIF and OFX (and QFX and QBO).

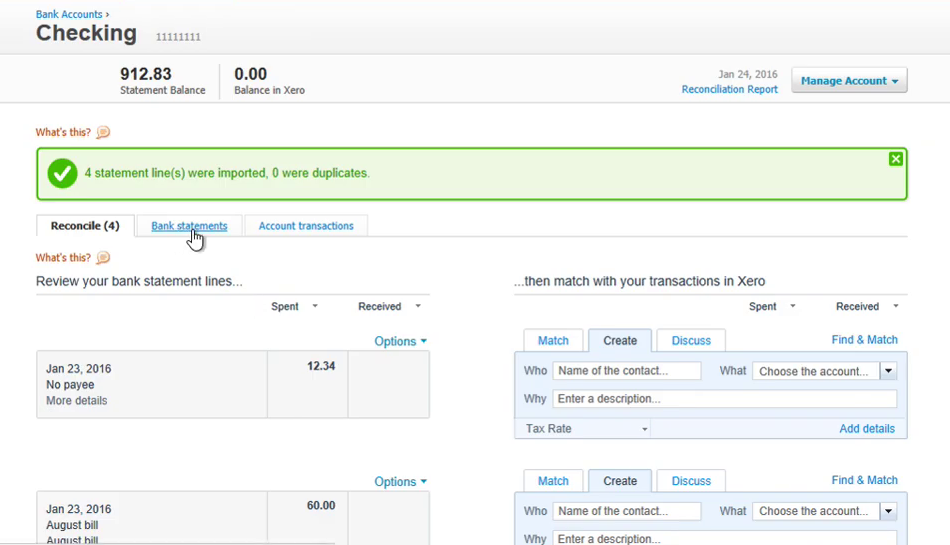

Import into Online Accounting Software (Xero, FreeAgent, Sage, others)

Online accounting services like Xero, FreeAgent, LessAccounting, MYOB, Wave, and others, usually imports OFX or QFX or QBO files and optionally CSV files. Search your accounting software documentation for things like "how to import a bank statement in [Xero, FreeAgent, etc]" to confirm which file format these services import.

Conversion Options for Different File Types

The ProperConvert app creates files with transactions in CSV, QIF, QFX, OFX, QBO format. It works with bank statement files or bank files (CSV, PDF), online bank or financial institutions accounting downloads (CSV, QFX, OFX, QBO, QIF, MT940). Both bank account transactions and credit card transactions are supported. Check which file types your accounting software imports and convert to a file with expected file extension.

Types of Transactions to convert

The ProperConvert app converts bank and credit card transactions. Depending on your accounting software, each type of transaction could have slightly different definition (for example, when compering QuickBooks and Quicken), but overall supported transaction types are deposit, check, payment, credit card charge, credit card payment, credit card refund.

Convert General Journal Entries

Import General Journal Entries Into QuickBooks

For QuickBooks desktop, convert to IIF format almost any available QuickBooks version or QBJ format if you have QuickBooks Desktop 2013 or later, QuickBooks Enterprise 13 or later, QuickBooks Desktop for Mac 2013 or later.

Convert multiple journal entries as one file

The GJE app converts multiple journal entries in your CSV or Excel in one IIF or QBJ file.

To help you work fast and efficient with one CSV or Excel, the app supports processing of multiple journal entries.

Work in Excel or export from other system in your workflow

Your ecommerce, production or other purpose system may export general journal entries as CSV or TXT format. The GJE app understands different date formats, numeric formats, decimal and other separators, encodings, so you can use exported CSV file with minimal or no changes required.

IIF or QBJ choice

The IIF and QBJ formats have their advantages and disadvantages compared to each other in different situations. With the GJE app you have a choice to utilize each format effectively.

Backup your accounting software company data file

Before importing any files into your accounting software, make sure to backup your company data file. Apps like QuickBooks or Quicken provide easy to use and fast backup options that will take few seconds and save you lots of lost time in case of incorrect import. Import data with confidence you can easily rollback to previous state. Do backups for major changes like disabling online services as well.

Many accounting software packages like QuickBooks Desktop (any edition like QuickBooks Pro or QuickBooks Premier or QuickBooks Accountant) provide a buffer zone (bank feeds center) to review imported transactions and delete (ignore) or add to the register. Online solutions like Xero or QuickBooks Online have similar interface to review and match imported transactions.

Frequently Asked Questions?

How can I use ProperConvert to convert transactions?

- Backup your accounting software file

- Download, install and run the software

- Select a file with transactions and review transactions

- Click Convert to convert to a format your accounting software imports

- Import created file into accounting software

Why should I trust ProperConvert?

- It runs and processes your files on your computer

- It does not send your transactions anywhere

- Please check our product testimonials

If I need any help with conversion, can you help me?

- Free support is available before and after the purchase

- All license options include specified Premium support period after the purchase

- The Personal and Team licenses include ongoing conversion support

Can I try before purchasing?

- Yes. ProperConvert is free to download and try.

- Your file will be fully parsed in the trial mode, so you can verify that ProperConvert understands your transactions file correctly.

- You can create a fully functional and loadable file before purchasing (with limitation to 10 transactions - this limitation is removed after you register).

Can I try without limits?

- Yes. We suggest to order a monthly subscription and try without limits. We offer 14 days unconditional money-back guarantee. We appreciate any feedback you can share.

- Convert your monthly subscription to another subscription - purchase a license suitable for your needs and let us know you are switching from the monthly subscription and we will credit the money you already spent.