Convert CSV/Excel files to OFX and import into Quickbooks Online, Xero, Microsoft Money

If you have CSV or Excel file with transactions data and your accounting software imports only OFX, or it imports CSV and OFX, but does not import your CSV/Excel, you may need to convert your file to the OFX file as better import option.

Try ProperConvert app. It converts CSV/Excel files to OFX format.

Convert transaction files from CSV to OFX format

- ProperConvert extracts transactions data from CSV/XLS/XLSX files. It creates OFX files ready to import into Xero, Sage One or other OFX importing software or online service.

- No data entry: convert data you already have in bank or credit card transactions data file format to the OFX format

- Smart: ProperConvert understands many layouts. It finds columns like date, amount, description, etc. of your transactions data.

- Easy to use: Converting your banking transactions data into OFX files could not be any easier. In a few clicks, you will have all your transactions converted to importable by Xero, Sage One or other OFX importing software or online service format in no time at all.

- Free trial and support: try it for Free before you buy and receive full support before and after you order.

- Safe to use: ProperConvert converts all your banking transactions data on your computer.

Convert XLS to OFX Step by Step Guide

To convert XLS to OFX (Excel file to OFX format), you can use the following method.

Prepare your Excel file

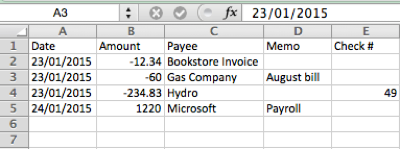

- Open your XLS file in Excel and examine it. If transaction columns do not have the header, simply add them (if possible)

- Use the following sample CSV file (Excel opens it) as a guideline how your Excel spreadsheet should look like for easy parsing

- Select all transactions data including the header (or just press CTRL+A) and copy to the clipboard (CTRL+C)

Install and start the ProperConvert app

- Download and install ProperConvert, make sure the file is digitally signed by ProperSoft on PC, and on Mac, you should be prompted to allow running the app from an identified developer

- Start ProperConvert and click the Paste from clipboard button

- Adjust the mapping if required

- Examine the transactions data on the Transactions tab for dates, amounts, memos, and other columns correctly assigned

Once downloaded and installed, start ProperConvert. Read the welcome message that provides the main points about the conversion process.

Select a file with transactions data that you would like to convert. It could be CSV or Excel file bank or credit card statement downloaded from online banking.

Review transactions data before converting, make sure dates are correct, expenses are negative, and payments to the account are positive.

Set account details

Make sure to set account details like account number, bank id, the currency is set to match the account settings in your accounting software. Some software like Sage, XERO do check them on the OFX file and if there is no match, refuse to import an OFX file.

Set the Account ID and Account Type. The Account ID must be digits only. You can enter the actual account number or credit card number, or a shortened number. It is important to use the same number when you convert multiple files for the same account and use a different number, when you start converting for another account.

For example, let's start with the first file for a checking account. Convert the first file and use account id as 10000001. Then you convert a second file for the same checking account, keep the same Account ID 10000001.

Then you start with a credit card account. For the first file for the credit card account, change the Account ID to another number, for example, 10000002. For the second file for this credit card account, keep the Account ID as 10000002.

When you start working with another account, make sure to adjust the Account Type as well.

The Currency can be adjusted and specific accounting software may require the Currency match as well as Bank ID and Branch ID.

The OFX target is important to set matching your accounting/finance software, as the converter will create the OFX file version compatible with your software.

There are some other settings that discussed in another video, we would skip these for now as you need them only in specific situations and you know when you need to change these settings.

Convert to an OFX file

Set the “Open after save” checkbox if you would like the software installed on your computer to open the created OFX file. If you have MS Money installed, it would be MS Money to open this OFX file.

Click the 'Convert' button.

And confirm the filename and the file location.

The converter offers to save an OFX into the same directory as a CSV/Excel file. If you are using the copy/paste method, you may need to change the directory to save the OFX file

Import into MS Money

- Start your software (MS Money) and select File, then Import, Statement file under the main menu and import the OFX file

To import the created OFX file manually in MS Money:

- Click File, Import, Downloaded Statement.

- Select the created OFX file. Click the 'Import' button.

- Import complete.

- Review transactions data.

Import into Sage (Sage 50, Sage One)

- Start your software Sage and import the OFX file

Import created OFX file into Quickbooks Online

- Look for 'Banking' and click on it.

- Select the account you want to import your data into.

- Click the 'File Upload' button. In your accounting software, look for 'Import a statement', 'Upload a bank file', or similar links to upload created OFX file.

- Click the 'Browse' button and select the created OFX file. And click 'Next'.

- Then select an account in Quickbooks Online to import and click 'Next'.

Once the transactions data are imported, you can review, categorize them under the account and add them to the register.

The Payee name did not assign because this is Vendor Record that you have to select in Quickbooks. This is not an actual Payee from the OFX file.

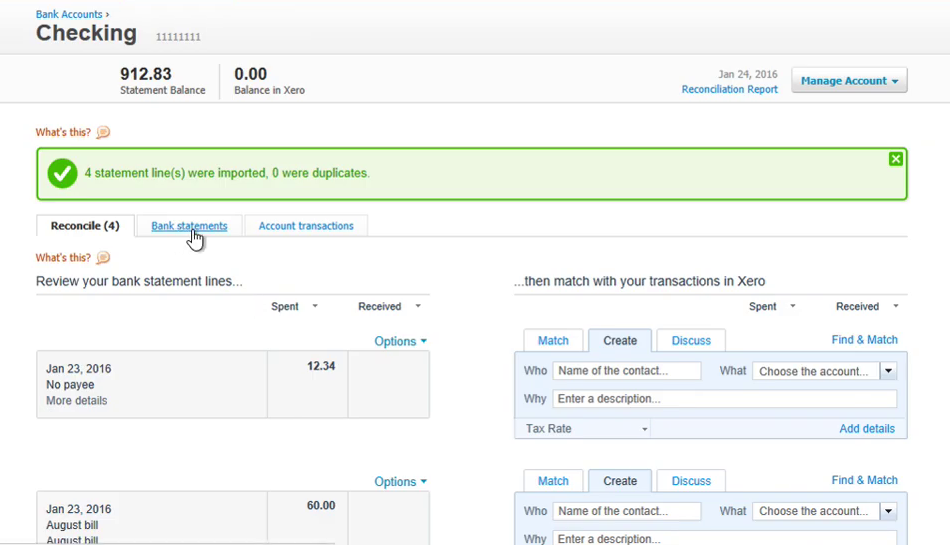

Import created OFX file into Xero

- Click on 'Manage Account' and look for the link 'Import a Statement'.

- Click the 'Browse' button and select the OFX file.

- Click the 'Import' button.

- Once the transactions data are imported, you can review, categorize them under the account.

Learn More

- OFX - What Is OFX File Format and How to Open it?

- QuickBooks - How to import transactions into Quickbooks

- QuickBooks Online - Import a Transactions file into Quickbooks Online

Related articles

- Convert CSV/Excel to QIF and import into Quicken, Banktivity, MYOB #quicken

- What are OFX, QFX, QBO (Web Connect) files?

- How to Convert Bank Statement PDF to CSV

- Convert PDF to OFX

- Convert PDF to QBO and import into QuickBooks

- Convert PDF to QIF and import into Quicken Classic, Banktivity, YNAB, MYOB

- Convert QIF to OFX and import into Xero, QB Online, Sage One, YNAB, AccountEdge